What Are The Do's and Don'ts of Investing

Beginning to invest can be an intimidating thought, particularly for those who have no history. It is essential to invest with the proper information to get the highest returns and dodge high-priced errors. This post will give beneficial guidance on the dos and don'ts of investing so that buyers can make informed judgments. From grasping basic ideas, such as risk and return, to becoming familiar with varied kinds of investments, we will help you initiate the route to prosperous investing.

Do's

Do your research

Every successful investor has a strategy for their investments. Understanding the available options and studying market trends are essential components of making informed decisions and achieving investment goals.

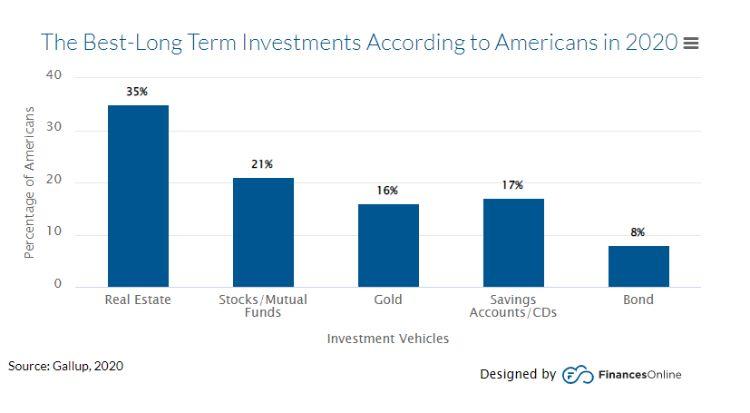

Researching each investing option is the first step to creating an effective strategy. Knowing the risks associated with stocks, bonds, mutual funds, real estate, and other options can help investors make well-informed choices. It's also important to understand which investment products fit different types of portfolios in terms of risk tolerance, liquidity needs, and return objectives.

Studying market trends helps investors better anticipate price changes in securities or other investments that may affect their portfolio returns. Keeping up with news releases on economic indicators such as interest rates, consumer confidence levels, inflation numbers, etc., can help inform decisions by providing insight into potential market opportunities or risks over time.

Start early

One of the most vital tips to keep in mind is to start early. Investing early allows your money to benefit from compounding interest, meaning any returns or gains on an investment will be multiplied over time as you continuously reinvest them. This can significantly increase your earnings without adding any additional effort or expense – something that cannot be accomplished by simply saving money in a traditional bank account. Additionally, investing early may lower the risk associated with certain investments since there is more time to recover from any potential losses incurred along the way.

It's important not to jump into investing without proper research and setting realistic expectations for what type of return can be expected. Be sure to evaluate possible risks associated with any investments before committing funds so you can make sound decisions about what may work best for you and your financial goals over time. Investing smartly requires careful consideration, but if done correctly, it can pay off in both the short-term and long-run as compound interest works its magic.

Credit: adamenfroy.com

Diversify your portfolio

Diversifying your portfolio means spreading the risk across different investments, such as stocks, bonds, mutual funds, and exchange-traded funds. This strategy works to diminish the potential impact of losses on any type of investment or sector while also helping maximize the potential for gains.

Diversifying helps reduce risk because you are shaking up your portfolio by investing in a mix of short-term, medium-term, and long-term investments with different return styles. Your primary objective should be not to put all your eggs in one basket and spread out the risk accordingly so that no single bet is overly large relative to your total portfolio value. Spreading out investments over multiple investment products can make it significantly less likely that all will suffer significant losses at once.

It's important to note that diversification does not guarantee against financial loss, but it does help reduce exposure when things don't go according to plan. The key is regularly monitoring each investment. Review news updates; chart progress; track performance metrics; keep an eye on dividend payments, etc. – so you can rebalance as appropriate and take advantage of new opportunities while maintaining risks manageable over time.

Have a plan

Investing may not be free from danger, but with a thoroughly prepared plan, the chances of suffering significant losses can be reduced. One of the basic steps in developing an efficient investment strategy is specifying attainable investment objectives. Taking the time to arrange your aims, such as how much money you have to save for retirement or what rate of return on investment you want to get, will assist you in forming an investing strategy that suits your requirements.

Once your investment strategy is determined, it's time to carry it out. To get the best possible return on your investments:

Spread them across various asset categories and timeframes.

Examine carefully which stocks or funds you invest in so they are compatible with your long-term objectives by scrutinizing their past returns and consulting investing professionals. Stay abreast of the market by subscribing to bulletins or following news sources.

Lastly, consider using stop-loss orders to protect yourself against sudden price drops in individual stocks or mutual funds without constantly monitoring daily trading. Although no one can predict how markets will behave over time, taking these precautionary measures will help protect against unnecessary losses during volatile periods in the market, widely known as corrections.

Credit: seekingalpha.com

Don'ts

Don't invest in things you don't understand

When looking at investments, it is critical to comprehend the fundamental investing standards. A lot of people make the misstep of investing in items they don't grasp because of inquisitiveness or peer pressure, which can be very costly. The trick is to dodge intricate investments and stay with ones you have researched and comprehended.

Before making any decision, consider the risk associated with an investment opportunity or security. Ensure that it fits within your financial goals and comfort level for risk. Even if an investment seems promising on paper, be sure to get all available information before moving.

You should also resist the temptation to chase high returns – higher rewards generally come with higher risks unless you're investing in something that has reliable returns, such as stocks or bonds. Investing should never be done out of emotional impulse. Instead, use due diligence and research each opportunity thoroughly before deciding whether or not it's right for you.

In conclusion, when considering investments, always do your homework first, so you know exactly what you're getting into – don't invest in things that are too complex or offer high returns without any explanation, as these can carry more risk than reward if done incorrectly.

Don't invest on emotions

Reckless choices are frequently motivated by fear or avarice, but these feelings should be sidestepped when dealing with funds. Instead of acting without thought, investors should investigate the dangers and profits related to any venture before giving money. By knowing possible chances and the potential costs they may face, they are better prepared to make wiser investments.

It's also important for investors not to get overly confident in their financial knowledge – even if they have been familiar with the stock market for many years. It's still important to keep abreast of investment changes and economic trends. Markets change over time, as do regulations and legislation concerning funds management. Knowing the latest updates can help investors spot new opportunities or react quickly to substantial losses. Staying informed can also help you avoid excessive risks resulting in monetary losses and emotional distress.

Don't put all your savings into investments

When it comes to building wealth, investing can be a beneficial strategy. However, you should not commit all of your savings to investments or take too much of a chance with your finances. Establishing an emergency fund will provide you with financial stability in times of difficulty, as well as alleviate any worries associated with depending solely on investment income.

When structuring a balanced portfolio, try to spread out your investments across multiple high- and low-risk products. Diversifying your portfolio ensures that if one asset performs poorly, another asset may fill in the gap and help protect against losses. It also allows you to choose assets that may suit different needs or goals in the long run.

Balancing investments with savings will help you manage short-term and long-term goals simultaneously. You should always consult a professional when making decisions regarding investment strategy or entering into new ventures, as they are often better equipped with the latest market information or risk management strategies. Taking risks without proper knowledge can sometimes end up costing more than if you were to play it safe and maintain consistent savings habits.

To sum up

Ultimately, investing can be a great way to augment your earnings or create a reserve for retirement. Knowing the fundamentals and researching before investing are fundamental steps to success. With the right education, you will be capable of making informed decisions when entrusting money. The secret is to uncover an investment approach that meets your needs and stick to it. With the correct understanding, you can realize your financial ambitions through prudent investments.